Net Salary Calculator Switzerland

505 of salary without a ceiling Unemployment Insurance UI. All bi-weekly semi-monthly monthly and quarterly figures.

Base Salary Explained A Guide To Understand Your Pay Packet N26

Need more from the Switzerland Tax Calculator.

Net salary calculator switzerland. This hourly rate calculator only in German available is very helpful. In common with many countries Swiss tax returns are complex. The gross monthly salary median value.

For instance an increase of. The latest budget information from April 2021 is used to show you exactly what you need to know. The net salary and gross salary calculator on moneylandch makes it easy for you as an employee in Switzerland to find your net salary based on your gross salary and to find your gross salary based on your net salary.

Calculate your take home pay in Switzerland thats your salary after tax with the Switzerland Salary Calculator. Why not find your dream salary too. Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year.

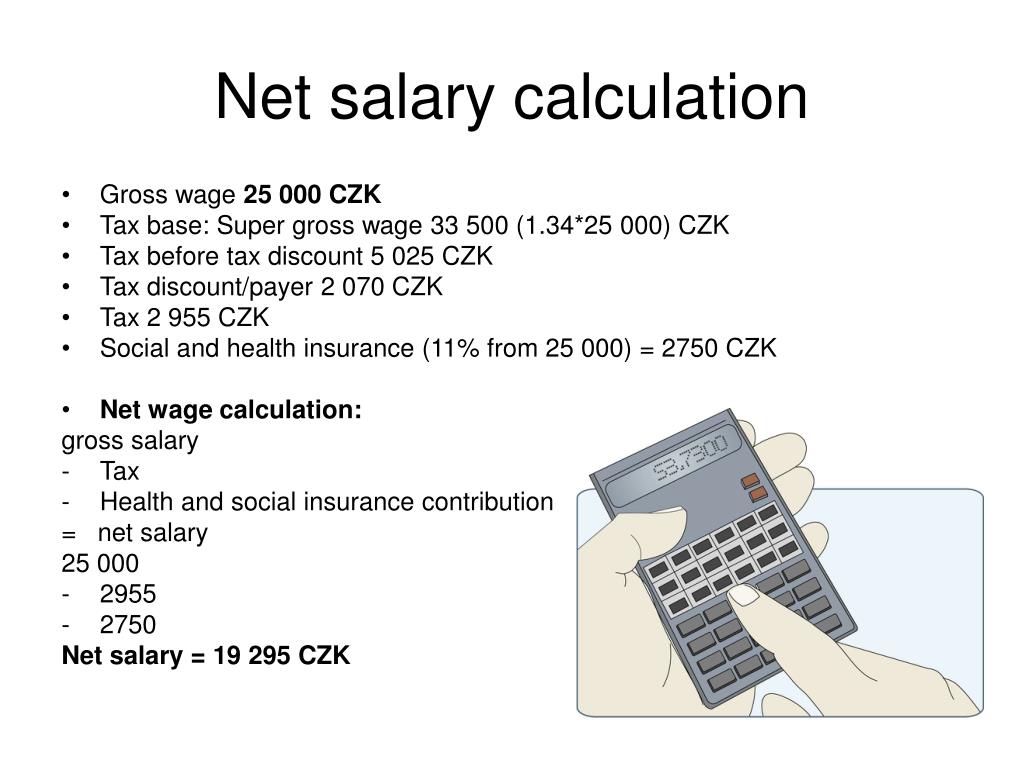

Gross to net sample calculation rounded. In analogy with many european countries stipend or scholarship holders instead of employment are exempted from. The average wages can be shown for the whole country by canton or by location.

On the Federal Tax Administration website you can calculate the amount of income tax you will have to pay using the online tax calculator includes comparison between cantons. That means that your net pay will be CHF 41602 per year or CHF 3467 per month. What are the approximate costs of living expenses in Switzerland.

Statutory assessment Gross annual incomes above CHF 120000 are subject to a retrospective tax assessment. Old-Age and Survivors Insurance OASI Disability Insurance DI and Income Loss Insurance. Postdoc and PhD students In Switzerland similar to Germany Denmark England and Sweden are mainly employed by the host institution through national or international funds or received scholarship.

If youre married youll need to fill out a joint tax return and your calculation will be based on the combined income of. One of a suite of free online calculators. The Switzerland tax calculator assumes this is your annual salary before tax.

This is the amount of salary you are paid. With direct grossnet conversion. 1 of salary ceiling.

This means that your tax calculation in Switzerland is a combination of the rate set by the government and the rate in your local area. Calculating obligatory insurances and taxes. Hourly rates weekly pay and bonuses are also catered for.

Our database already includes the most important professions others are added constantly. Just two simple steps to calculate your salary after tax in Switzerland with detailed income tax calculations. The salary calculator helps you calculate your salary deductions and withholding tax.

The adjusted annual salary can be calculated as. The salary dispersion interquartile range. Gross salary is CHF 200000.

If you then want to know exactly how much tax you have to pay on your profit not turnover based on the calculation you can actually use any income tax calculator. The results do not represent wage recommendations. Most people will come under rate A B or C.

Resident in the canton of Zurich city of Zurich no church taxes no asset taxes. Net salary calculator switzerland Postdoc and PhD salary in Switzerland. The statistical salary calculator Salarium is an interactive application which allows you to obtain for a specific job region economic branch occupational group etc and for a selection of individual characteristics age level of education years of service etc the following salary information.

What is left of the net income. A quick and efficient way to calculate Switzerland income tax amounts and compare salaries in Switzerland review income tax deductions for income in Switzerland and estimate your tax returns for your Salary in Switzerland. With the calculator below you can calculate how much sourcetax you can expect to pay depending on your monthly gross salary.

We will give you an example. This marginal tax rate means that your immediate additional income will be taxed at this rate. The cross border rates are for.

Thanks to the salary calculator of jobsch you can compare the average salary for all common professions in Switzerland. Your average tax rate is 168 and your marginal tax rate is 269. The salaries are calculated based on salary indications of thousands of registered users on jobsch and help you to better understand what you can earn in which region and in which sector.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. The calculator accounts for Swiss OASIDIEO contributions unemployment insurance ALV contributions non-occupational accident insurance NOAI premiums paid sick leave insurance premiums and occupational pension fund contributions. However if you come to Switzerland as a foreigner to work your employer will probably have to deduct tax at source like PAYE.

Swiss tax laws consider families to be one unit for tax purposes. The national wage calculator enables you to calculate a monthly gross wage central value or median and the spread of wages interquartile range for a specific individual profile. If you make CHF 50000 a year living in the region of Zurich Switzerland you will be taxed CHF 8399.

The wage calculator was developed in the context of the flanking measures to the free movement of persons between Switzerland and the European Union. Salary calculator for computing net monthly and annual salary. Income tax in Switzerland is levied by both the federal government and your canton.

A direct overview of salaries and wages in Switzerland. If you wish to enter you monthly salary weekly or hourly wage then select the Advanced option on the Switzerland tax calculator and change the Employment Income and Employment Expenses period. 30 8 260 - 25 56400.

Eseu Halloween Tăcere Net Salary Calculator Belgium2019 Justan Net

Eseu Halloween Tăcere Net Salary Calculator Belgium2019 Justan Net

Salary In Switzerland Calculation Of The Net Salary From The Gross

Payroll Reconciliation Excel Template Inspirational 11 Payroll In Excel Format Free Business Template Example Payroll Template Statement Template Payroll

Base Salary Explained A Guide To Understand Your Pay Packet N26

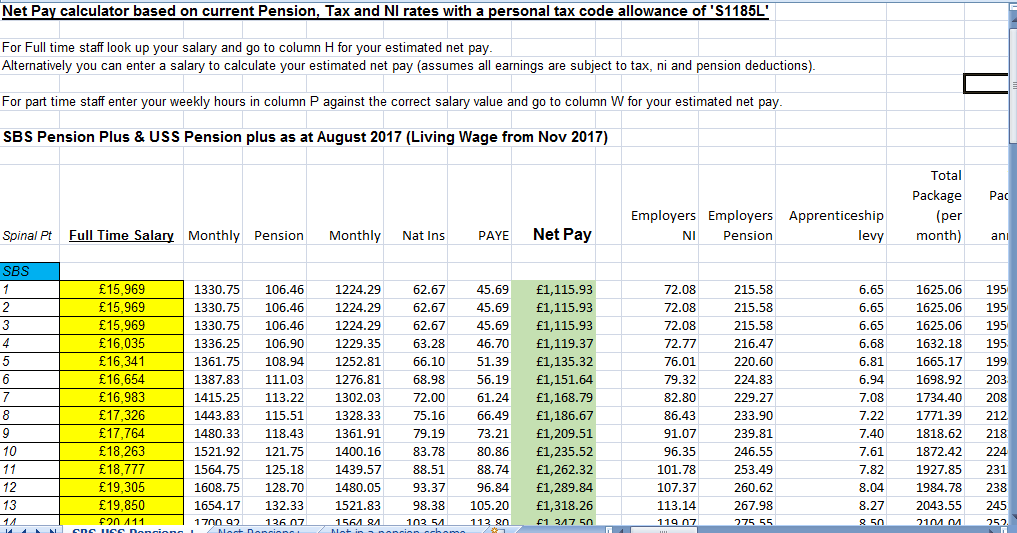

Salary After Tax Calculator For 2017

The Art Of Wishfin And Why You May Need This Investing For Retirement Personal Loans Finance

Photos Airbus A380 861 Aircraft Pictures Airliners Net Emirates Airbus Airbus Aircraft Pictures

Earnings Statistics Statistics Explained

Wealth Tax Ifi Notaries Of France

Payroll And Tax In Ireland Payroll Taxes Salary Calculator Tax Services

Calculating And Processing Net To Gross Salary In Swiss Sap Hr Payroll

Salary In Switzerland Calculation Of The Net Salary From The Gross

Taxes In France In 2021 All You Need To Know Moving To France

Eseu Halloween Tăcere Net Salary Calculator Belgium2019 Justan Net

Eseu Halloween Tăcere Net Salary Calculator Belgium2019 Justan Net

Eseu Halloween Tăcere Net Salary Calculator Belgium2019 Justan Net

Post a Comment for "Net Salary Calculator Switzerland"