Salary Sacrifice Vs Relief At Source

Cycle to work arrangements. As a reminder pension tax relief on employee contributions is given in different ways depending on the type of pension scheme the employer operates and whether or not salary sacrifice is being operated.

8 X 8 Group Personal Pension Plan Pension

It is not even strictly.

Salary sacrifice vs relief at source. The main advantage of salary sacrifice can be higher take home pay as youll be paying lower National Insurance contributions NICs. If your employer is using net pay or salary sacrifice then you dont get relief at source. However your pension contributions already include any tax that you would have otherwise paid for that income so the result is more or less the same.

You can even model different scenarios. When you salary sacrifice you agree to reduce your earnings by an amount equal to your pension contributions. If however the sacrifice lowers your earnings below the National Living Wage then the scheme wont be available to you.

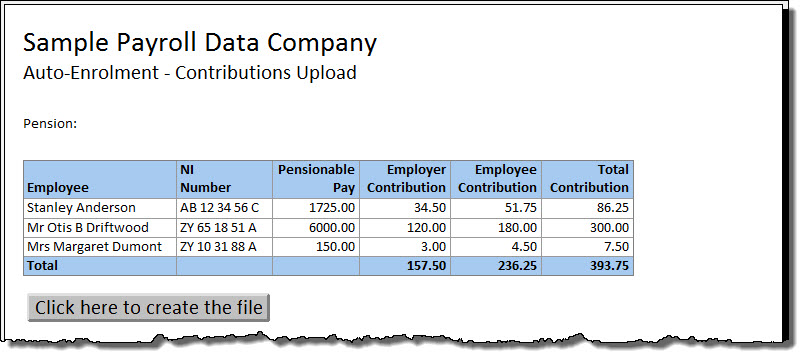

The scheme then adds an amount equal to basic rate tax relief which it then reclaims from HMRC. Sacrificing 1200 gives an employee a potential. The pension scheme administrator claims basic rate tax relief from HMRC and adds it.

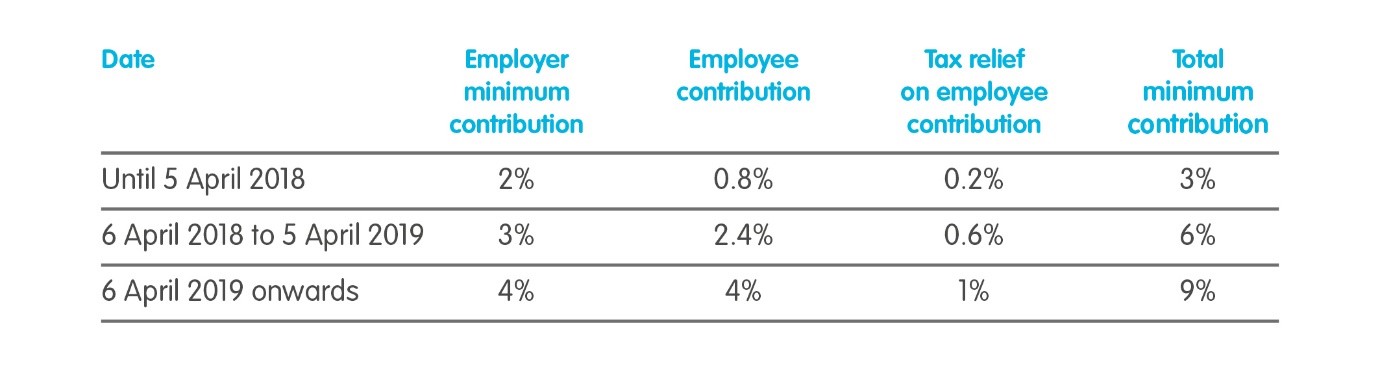

Their post exchange salary is therefore 47500 meaning that the actual employer contribution of 4000 1500 2500 represents 842 of the 47500 salary not 8. Because employee pension contributions qualify for tax relief anyway using salary or bonus sacrifice to fund an employer pension contribution doesnt produce an additional income tax saving. Contributions are 3 employer and 5 employee including tax relief.

What are the rules for salary sacrifice pension for higher-rate taxpayers. There are two advantages to the employees. What is salary sacrifice.

Under this tax basis youd deduct employee contributions from their pay after tax is taken. Thats why you dont get the additional tax relief on the contribution - but instead benefit via the explanations given above. Many employers offer to run their employees pension schemes in conjunction with a salary sacrifice arrangement.

Therefore salary sacrifice schemes are usually only arranged for non-taxable benefits such as. A salary sacrifice and a pension contribution are two completely different things and most people dont seem to understand this. This means tax relief cannot be claimed because the employee has been taxed on a lower amount of salary.

HMRC call it relief at source. Find out more about tax relief. Net tax basis is the default tax relief method with The Peoples Pension.

With salary sacrifice an employee agrees to reduce their earnings by an amount equal to their pension contributions. In a relief at source scheme contributions are deducted from the employees net salary ie. Most benefits in kind are treated as taxable.

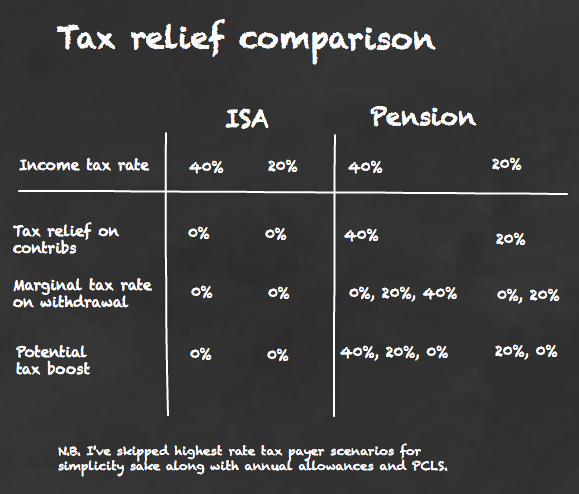

Relief at source is only available if you pay pension contributions from your after-tax salary. The employee sacrifices salary pays less tax and NIC as does employer and the employer makes a gross. When they surpass that their pension tax relief.

The aim is typically to replace taxable income with non-taxable income. Salary sacrifice is an employment agreement for reduced earnings in place of other benefits. The employee wants to use salary exchange to make their 2500 contribution.

If your employer offers a salary sacrifice scheme then you should be able to enroll in it. They do this because it saves both you and them National Insurance. Since 2015 there have been new rules for higher-rate taxpayers and tax relief treatment of their pension contributions including through salary sacrifice.

Your employer will also pay lower NICs. The main advantage of salary sacrifice is to maintain existing pension contributions at a lower cost or to increase pension contributions at no extra cost. The second benefit is that Salary is subject to National Insurance whereas Pension payments are not.

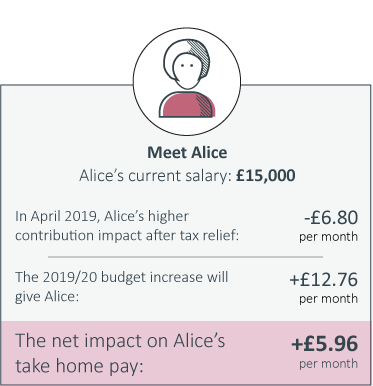

While basic-rate taxpayers receive tax relief on a maximum of 40000 per year of their total pension contributions for higher-rate taxpayers there is an upper earnings limit. She is therefore 3 a month or 36 a year better off under a relief at source scheme. You cant therefore claim additional tax relief because as an employee youve been taxed on a lower amount of salary.

Thats why we call this tax basis net. After tax has been deducted. The key point to note is that the scheme adds this top-up to the employees contribution.

However if the contributions are made by salary sacrifice the effective rate of relief could be as much as 66. However the employer deducts only 80 of the total contribution from the employees salary. So well automatically set you up on this arrangement when you sign up to The Peoples Pension.

Enter details of salary personal relief at source contributions and employers pension contribution to calculate the sacrifice required. The first is that for any who are Higher Rate Tax payers they do not have to claim Higher Rate Tax Relief and it potentially avoids the hassle of completing a Self Assessment Tax Form. You might benefit from more pension contributions from your employer if they are giving you some or.

This method of tax relief is used where the employee pension contribution is deducted from net pay.

Contribution Increases The Impact On You

Http Library Aviva Com Tridion Documents View Epen15a Pdf

Why Use Salary Or Bonus Sacrifice For Pension Funding Savvy Financial Planning

Sipp Tax Relief Calculator Tax Relief On Pension Contributions

Https Www Litrg Org Uk Sites Default Files 190509 Litrg Briefing Net Pay Arrangements Lower Paid Workers Final Pdf

Is Pension Salary Sacrifice An Answer Agewage Making Your Money Work As Hard As You Do

Pensions Auto Enrolment Low Incomes Tax Reform Group

8 X 8 Group Personal Pension Plan Pension

Everything You Need To Know About Salary Sacrifice Banker On Fire

Https Ssl Perquisite Net Brands Content 1610 Towergate 20salary 20sacrifice 20faq 2014 15 20v1 Pdf

Why Use Salary Or Bonus Sacrifice For Pension Funding Savvy Financial Planning

How Employees Can Reduce National Insurance

Why Use Salary Or Bonus Sacrifice For Pension Funding Savvy Financial Planning

Sipps Vs Isas Pensions Knock Isas Into A Cocked Hat If You Want To Retire Monevator

What Are The Minimum Contribution Levels When Pensionable Or Total Earnings Basis Is Used Help And Support

Everything You Need To Know About Salary Sacrifice Banker On Fire

Employee Tax Relief Brightpay Documentation

Is Pension Salary Sacrifice An Answer Agewage Making Your Money Work As Hard As You Do

Post a Comment for "Salary Sacrifice Vs Relief At Source"