Net Salary Calculator Nsw

Gross and Net Calculator. This means that a full-time worker on minimum wage could expect their pre-tax earnings to total 75380 per week 326646 per month or 3919760 per year.

Total Cost for Employer Wage Fund.

Net salary calculator nsw. Hourly rates weekly pay and bonuses are also catered for. You can then see how your salary is broken down into weekly fortnight or monthly earnings. If you are using the Pay Calculator as a Salary Calculator simply enter your annual salary and select the relevant options to your income.

Income tax on your Gross earnings Medicare Levy only if you are using medicare Superannuation paid by your employer standard rate is 95 of your gross earnings. PayCalculator is also available in the App Store. The app will work on all ios devices including iPad iPhone and iPod touch and will update every year.

This Australian Salary Calculator will show you what your weekly fortnightly monthly Income or Net Salary will be after PAYG tax deductions. The current Australian National Minimum Wage is 1984 per hour. The Australian salary calculator for 202122 Fortnightly Tax Calculations.

This calculator is always up to date and conforms to official Australian Tax Office rates and formulas. This places New Zealand on the 22nd place in the International Labour Organisation statistics for 2012. The average monthly net salary in New Zealand NZ is around 3 117 NZD with a minimum income of 2 157 NZD per month.

Simply enter your Gross Income and select earning period. Sydney influenced data the most obviously but heres the most popular pay calculations in New South Wales last year. Net pay annually Net pay monthly 90000.

Full-time workers usually work 38 hours or more per week. PayCalc is updated every year and currently you can use pay rates to calculate net pay for previous 20202021 and current 20212022 financial years. After changing the advanced tax calculator setting click on calculate to recalculate your tax deductions based on.

You can personalise this tax illustration by choosing advanced and altering the setting as required. Net to Gross Income - Rise High. In most cases your salary will be provided by your employer on an annual basis.

It can also take into consideration your. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Enter your Fortnightly salary and click calculate.

The Salary Calculator will also calculate what your Employers Superannuation Contribution will be. Why not find your dream salary too. This Calculator will display.

Values less than or equal to 1000 will be considered hourly. Finally Your Take Home Pay after deducting Income Tax and Medicare. Use this pay calculator to calculate your take home pay in Australia.

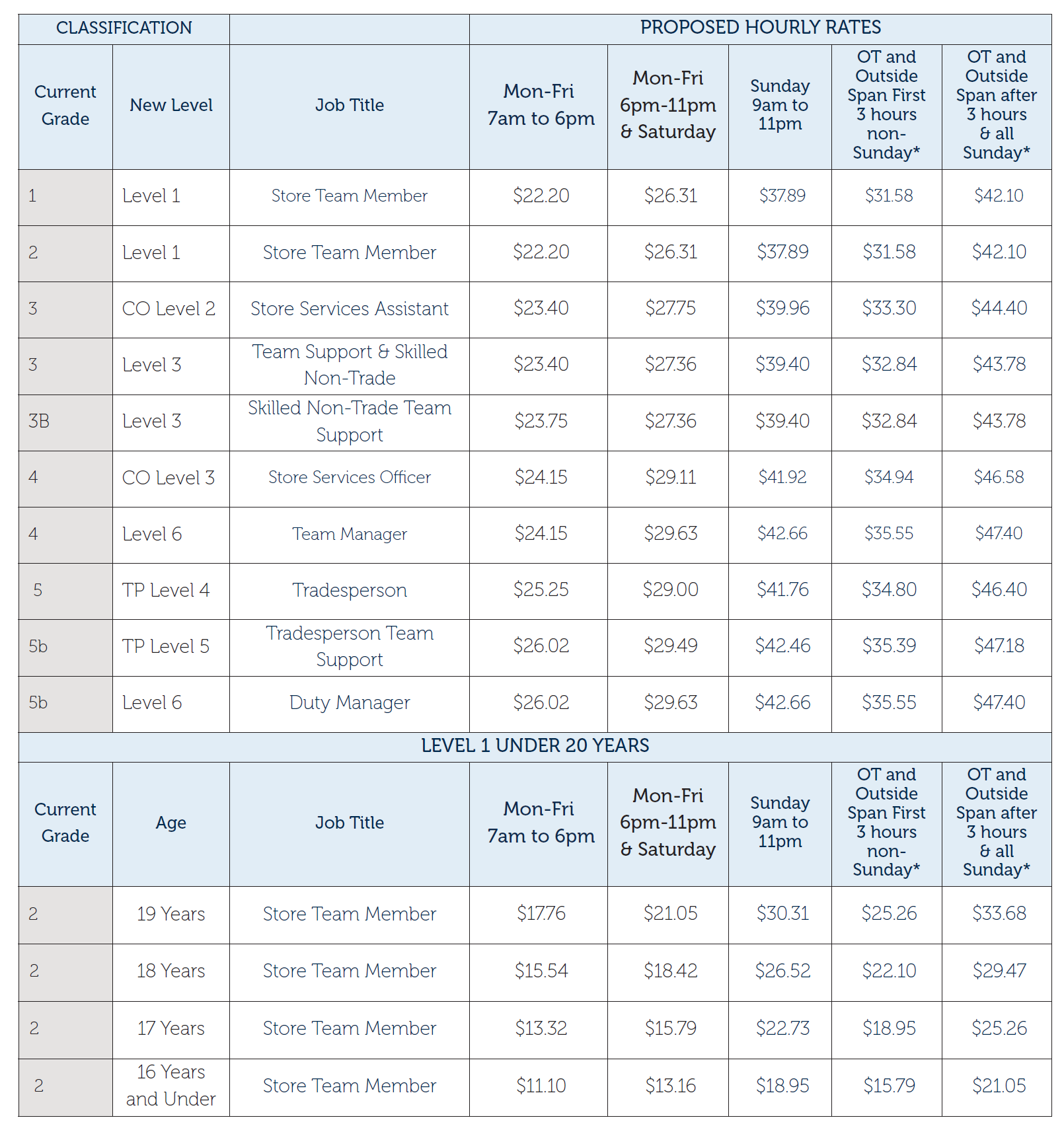

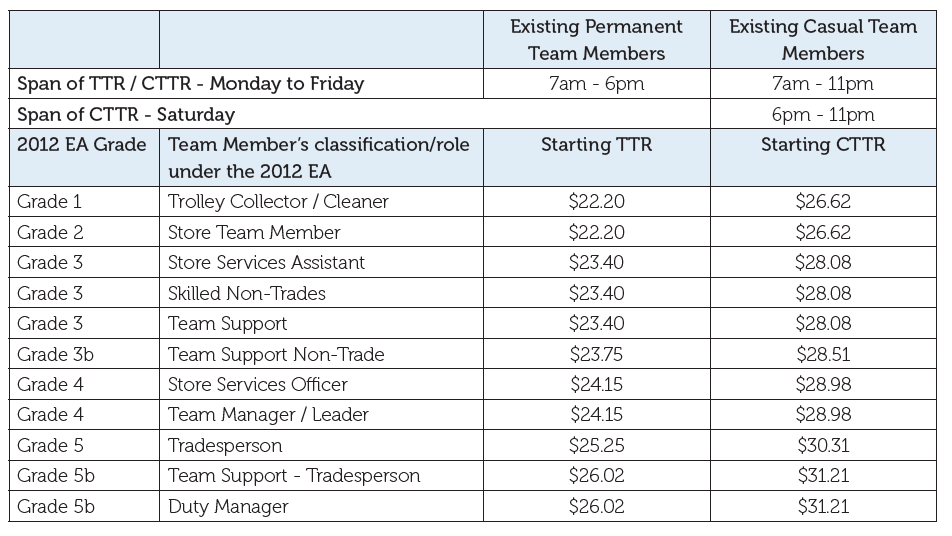

If you want to find out how much you should be getting paid or youre an employer or business looking for pay rates for employees you can use the online pay calculatorThe calculator will work out pay rates hourly and weekly penalty rates casual rates allowances shift work overtime and public holiday rates all based on the industry and role you enquire about. This calculator is an estimate. The calculations are based on personal income tax rates and thresholds for the 20192020 financial year and assumed salary packaging administration fees.

Use this calculator to quickly estimate how much tax you will need to pay on your income. The actual salary packaging administration fee can vary based on your employer policy and the benefits available. Calculate your take-home pay Superannuation Budgeting Net Worth Savings and plan for Retirement.

Tax on this pay. Funded pension II pillar. 3 You are entitled to 25000 Low Income Tax Offset.

It can be used for the 201314 to 202021 income years. And you can figure out are you eligible for and how much of Low Income Tax Offset you. The Fortnightly salary calculator for Australia.

108000 Low And Middle Income Tax Offset. Taxes are deducted from the gross. Employers in New Zealand usually deduct the relevant amount of tax from the salary through a pay-as-you-earn PAYE system.

The 70k after tax take home pay illustration provides a salary calculation for an Australian resident earning 7000000 per annum and assumes private medicare provisions have been made where necessary. The latest budget information from April 2021 is used to show you exactly what you need to know. This calculator will give you an estimate of your gross pay based on your net pay for a particular pay period weekly fortnightly or monthly.

If you have HELPHECS debt you can calculate debt repayments. You can alter and edit this calculator to work out your out salary using our the salary calculator for Australian income tax.

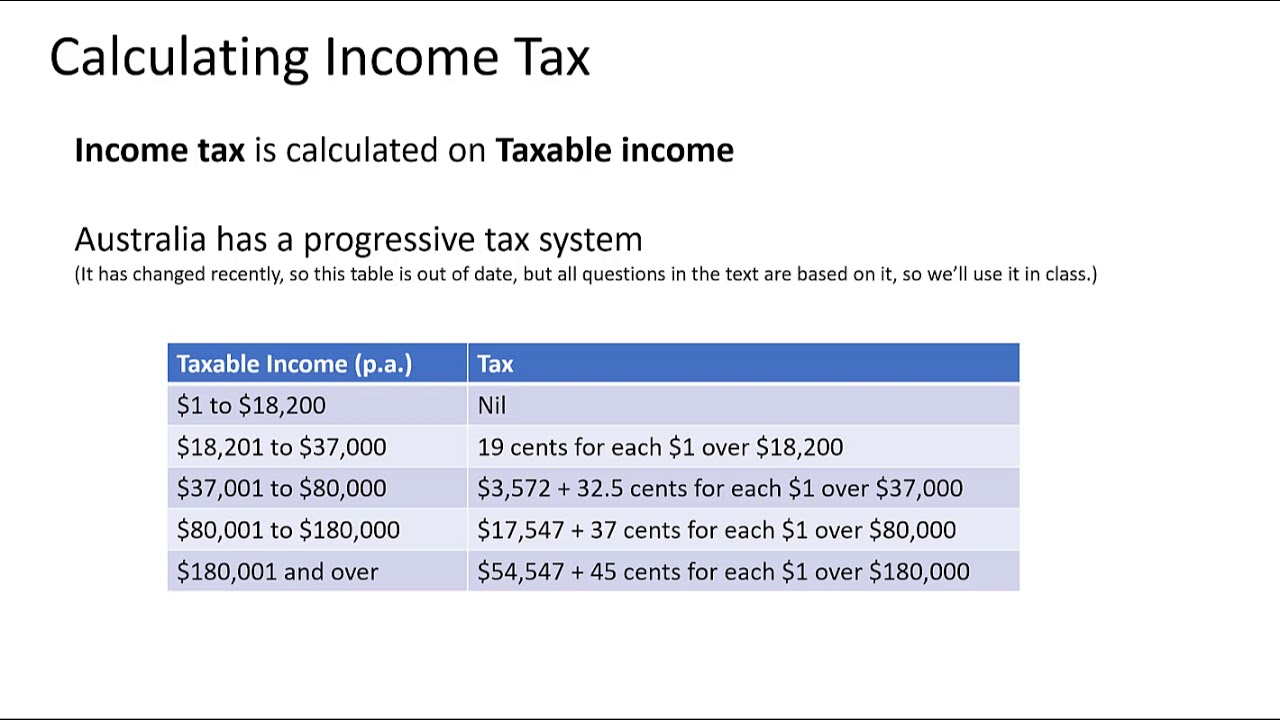

Prelim Standard Math Calculating Tax Art Of Smart

Income Gross Up Calculator Sweetie Lending

Income Tax Australian Tax Brackets And Rates 2020 21

Loan Calculators Noel Whittaker

We At Whiz Consulting Provide Online Bookkeeping Services At Low Costs Our List Of Extensive Servi Accounting Services Bookkeeping Services Budget Forecasting

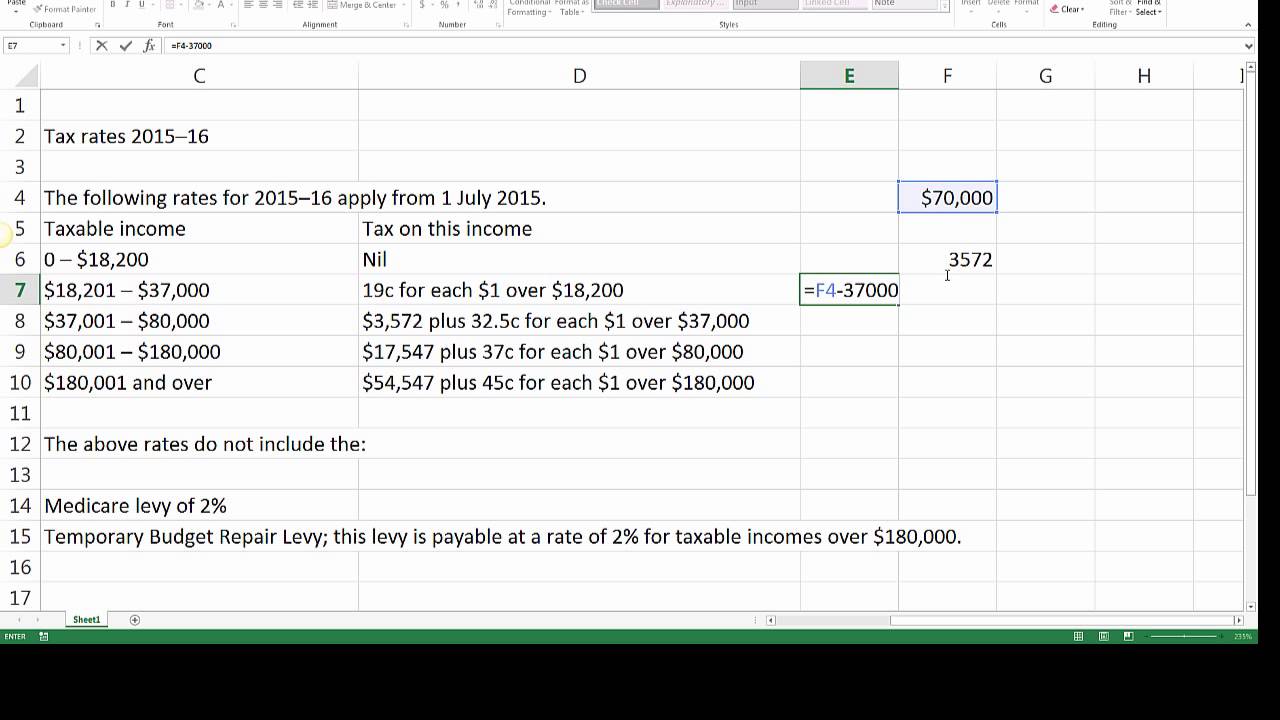

How To Calculate Payg Tax In Australia Tax Withheld Youtube

Tax Memo Is Sugar Baby Income Taxable Chris Whalen Cpa

Lump Sum E Payment Tax Offset 2021 Atotaxrates Info

Employee Cost Calculator The True Cost Of Hiring Box Advisory Services

Employee Cost Calculator The True Cost Of Hiring Box Advisory Services

Best Apps For Your 2020 Australian Tax Return

Https Www Salarypackagingplus Com Au Download Forms Nswhealth Relocation 20benefit Nsw Health No674 V1 Pdf

Employee Cost Calculator The True Cost Of Hiring Box Advisory Services

Post a Comment for "Net Salary Calculator Nsw"