Gross Monthly Income 63000 Per Year

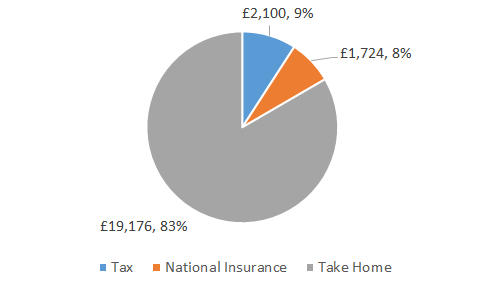

Gross Salary - Income Tax After deductions 5229436. If you earn 21500 a year then after your taxes and national insurance you will take home 18260 a year or 1522 per month as a net salary.

63 000 After Tax After Tax Calculator 2019

They can do so by multiplying their hourly wage rate by the number of hours worked in a week.

Gross monthly income 63000 per year. The following are only generalizations and are not true for everyone especially in regards to race ethnicity and gender. The calculations illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year assuming no changes to salary or circumstance. Hourly pay x hours worked 11 x 20.

On a monthly basis the effective gross income is 756000 12 or 63000. This income tax calculation for an individual earning a 6300000 salary per year. Effective Gross Income Multiplier EGIM.

Based on a 40 hours work-week your hourly rate will be 1345 with your 28000 salary. 70000 Salary Take Home Pay. What is a 63k after tax.

In the first quarter of 2020 the average salary of a full-time employee in the US. To determine gross monthly income from hourly wages individuals need to know their yearly pay. Yearly Monthly 4 Weekly 2 Weekly Weekly Daily Hourly 1.

Now lets see more details about how weve gotten this monthly take-home sum of 3765 after extracting your tax and NI from your yearly 63000 earnings. PRSI is only applicable to salaries higher than 5000 EUR per year. Employer Superanuation for 2021 is payable on all employee earning whose monthly income exceeds 45000 which equates to 540000 per annum.

Pay Related Social Insurance PRSI is a tax payable on the gross income after deducting pension contributions. One of a suite of free online calculators provided by the team at iCalculator. Is 49764 per year which comes out to 957 per week.

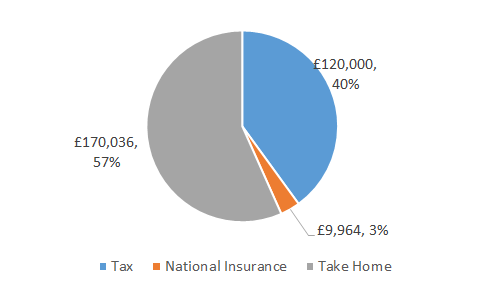

Alberta 6300000 Salary after Tax Calculations. You will pay a total of 12700 in tax this year and youll also have to pay 5120 in National Insurance. If you earn 63000 in a year you will take home 45180 leaving you with a net income of 3765 every month.

Income Income Period. Salary and Tax Illustration. Based on a 40 hours work-week your hourly rate will be 3030 with your 63000 salary.

Employer Superannuation is payable at 95 of Gross Income. Here are more examples for the effective gross income formula. Thus in doing our calculations here we assumed 2 percent for insurance and property tax and 34 percent for.

6300000 After Tax. To determine gross monthly income from salary individuals can divide their salary by 12 for the number of months in a year. 28000 Salary Take Home Pay.

Income Income Period. You will pay a total of 12700 in tax per year or 1058 per month. The total tax you owe as an employee to HMRC is 17771 per our tax calculator.

Income Income Period. Based on a 40 hours work-week your hourly rate will be 3365 with your 70000 salary. Based on a 40 hours work-week your hourly rate will be 1033 with your 21500 salary.

Since there are 12 months in a year you can estimate the average monthly earnings from your 63000 salary as 525000 per month. To find his annual income he multiplies his hourly wage by the hours of work he puts in each week. The resulting number can.

Gross monthly income 3750. Is a progressive tax applied on the gross income after certain capital allowances but before pension contributions. Of course some months are longer than others so this is just a rough average.

Research Maniacs checked with different financial institutions and found that most mortgage lenders do not allow more than 36 percent of a gross income of 63000 to cover the total cost of debt payment s insurance and property tax. 63000 after tax and national insurance will result in a 3765 monthly net salary in the tax year 20192020 leaving you with 45180 take home pay in a year. Determining hourly pay in a monthly period requires a more complex formula.

Miss Avasarala finds that she makes 1040 per month. Individuals that earn less than 12012 EUR per year are exempt from the Universal Social Charge. 63000 Salary Take Home Pay If you earn 63000 a year then after your taxes and national insurance you will take home 45180 a year or 3765 per month as a net salary.

See how we can help improve your knowledge of Math Physics Tax Engineering and. If you earn 28000 a year then after your taxes and national insurance you will take home 22680 a year or 1890 per month as a net salary. 21500 Salary Take Home Pay.

Gross income per month Annual salary 12. If you earn 70000 a year then after your taxes and national insurance you will take home 49240 a year or 4103 per month as a net salary. While this is an average keep in mind that it will vary according to many different factors.

4874800 net salary is 6300000 gross salary. Our salary calculator indicates that on a 63000 salary gross income of 63000 per year you receive take home pay of 45229 a net wage of 45229. Gross monthly income 12480 12 Gross monthly income 1040.

63000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2021 tax return and tax refund calculations. With her yearly income amount she can now divide by 12 for the months in the year to determine her gross monthly income. Lenny makes 3750 per month.

Joaquin makes 11 per hour as a waiter working 20 hours per week.

63 000 After Tax Take Home Pay Calculator 2021

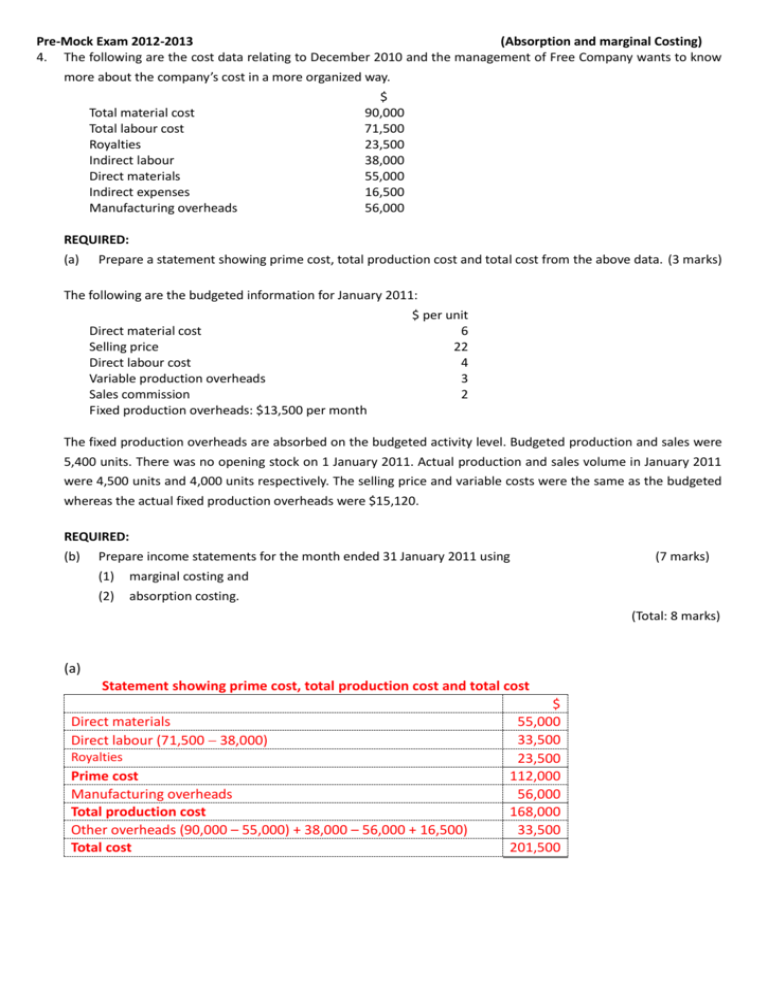

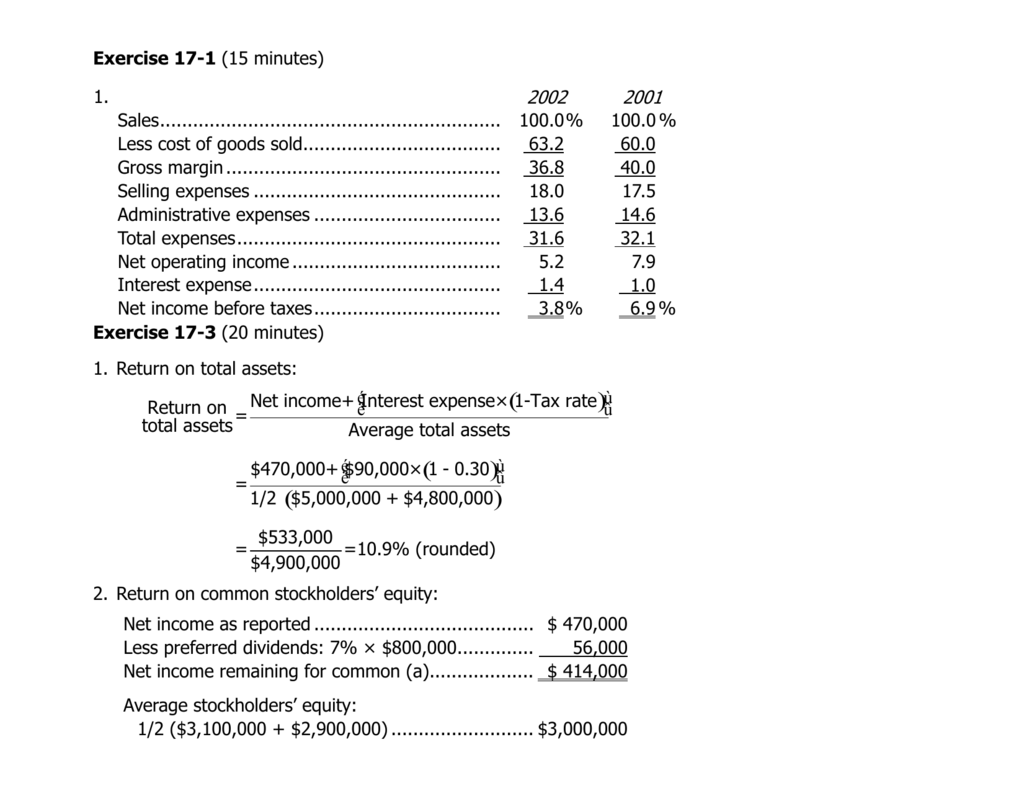

Examen Accounting 2 Segundo Examen Docsity

Is 63 000 A Good Salary In Berlin

Gross Net Salary The Urssaf Converter

63 000 After Tax 2021 Income Tax Uk

Quick Answer Take Home Salary Calculator India Kerala Travel Tours

How I Spend My Money A 28 Year Old Doctor Commuting From Dublin To The Midlands On 63 000

Is 60 000 Euros A Good Salary In Germany Quora

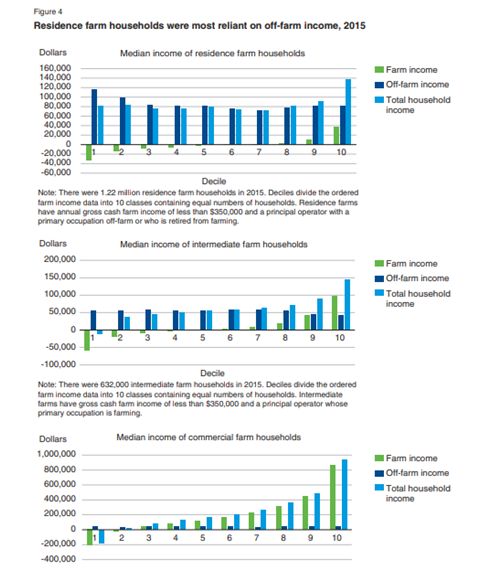

Family Farmers Are They Paupers Or Princes By Natasha Paris Medium

63 000 After Tax Income Tax Calculator 2019

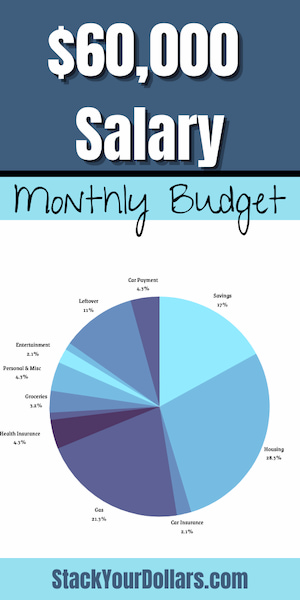

60 000 A Year Is How Much An Hour And Why It S Great Stack Your Dollars

63 000 After Tax De Breakdown July 2021 Incomeaftertax Com

Post a Comment for "Gross Monthly Income 63000 Per Year"