Salary Sacrifice To Super

I have just asked my employer to salary sacrifice some of my wages into super for a voluntary contribution for the first time. The amount you sacrifice from your pay is an extra amount into your super that is on top of your employers compulsory super contribution.

This also means youll reduce your taxable income as youll essentially be taking home less money.

Salary sacrifice to super. Will salary sacrifice mean I should increase the annual income I disclose to. What is salary sacrificing. You can nominate a dollar amount or a percentage.

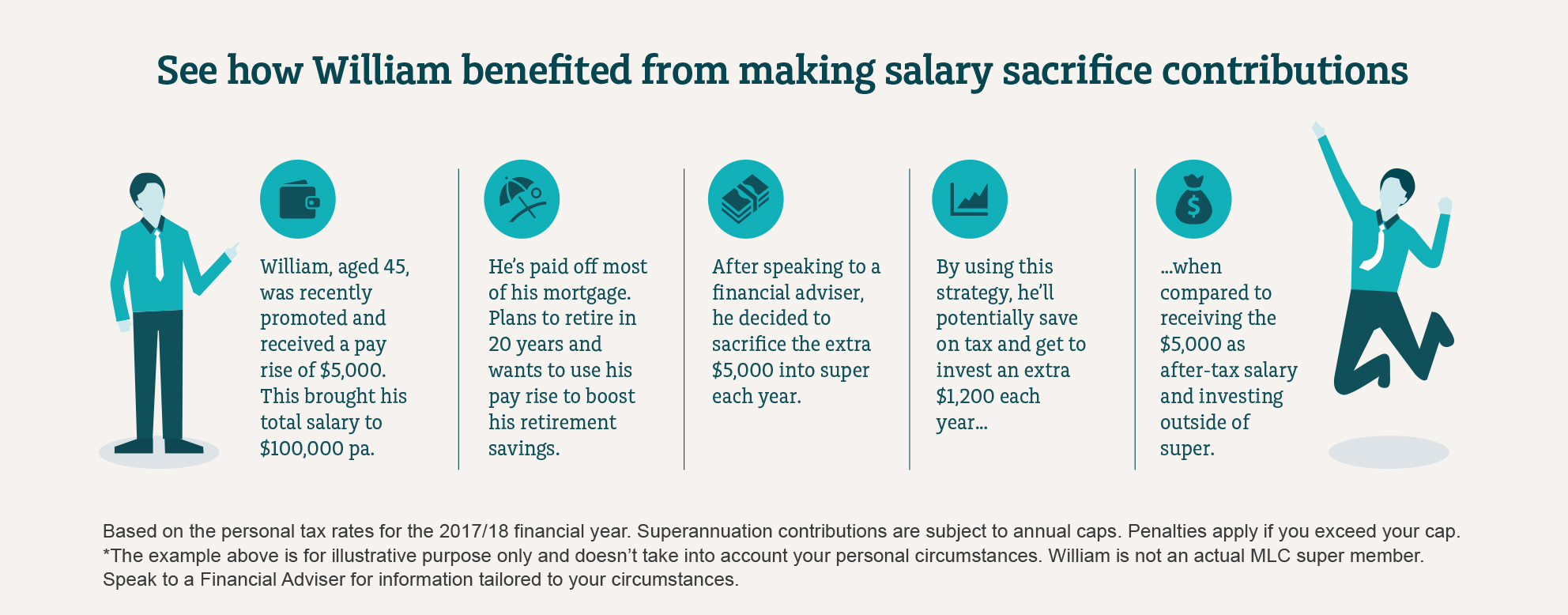

Sacrifice what you can easily afford up to the cap and take advantage of any employer match schemes associated. What are the benefits of salary sacrifice into super. One example of a salary sacrifice arrangement is to have some of your salary or wages paid into your super fund instead of to you.

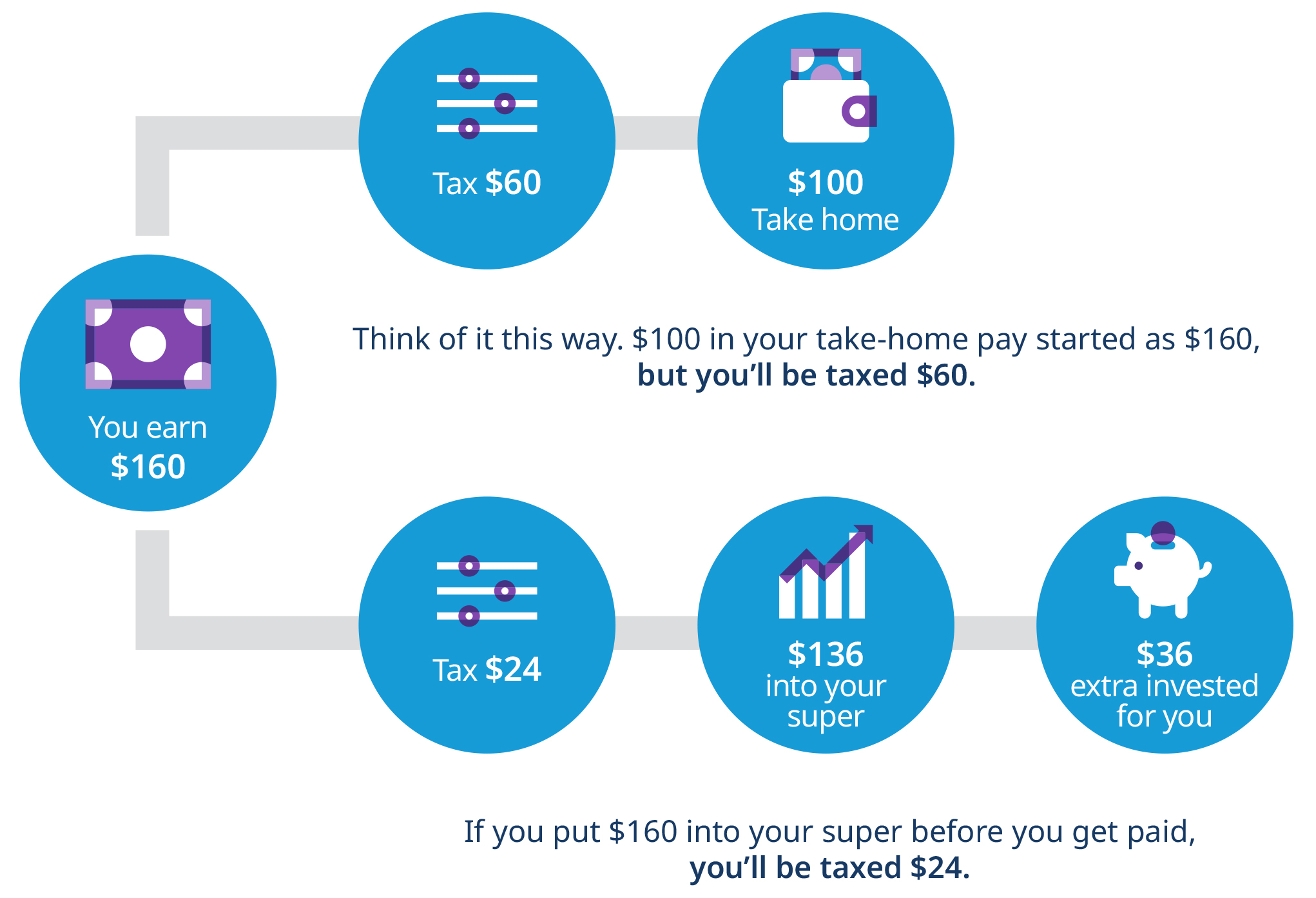

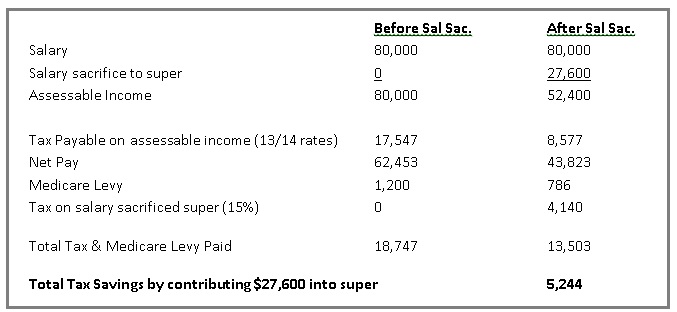

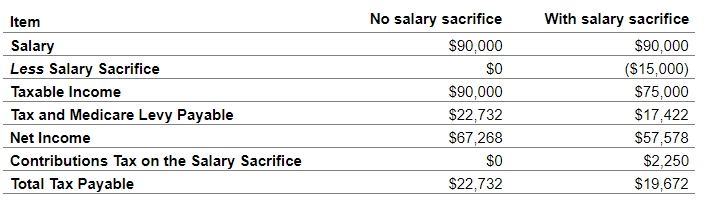

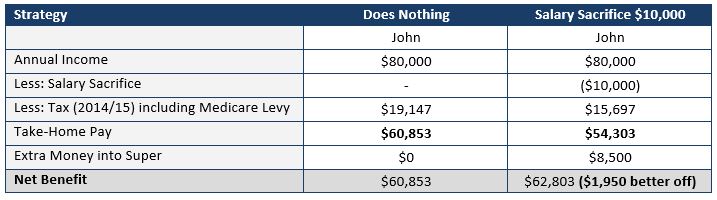

Salary sacrifice is an arrangement with your employer where you can ask them to add some of your pay before tax directly into your super. As salary sacrifice contributions come from your pre-tax salary you only pay 15 on them when they enter the super system if you earn less than 250000 or 30 if you earn over this amount. This is a lower tax rate than most employees pay on their income which can be as high as 47 with the Medicare levy in 202122 so these types of arrangements can be a good way to reduce your tax.

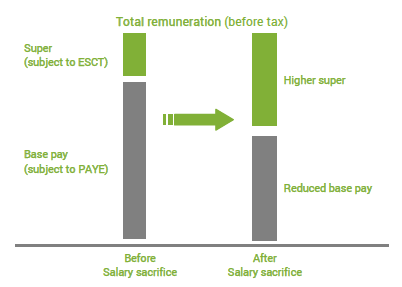

Salary sacrificing to super Before-tax or concessional contributions are super contributions that come out of your before-tax pay. Salary sacrificing is a method of diverting part of your salary into your super before you are charged any income tax. Salary sacrificing is the process of directing some of your pre-tax income into your super instead of your bank account.

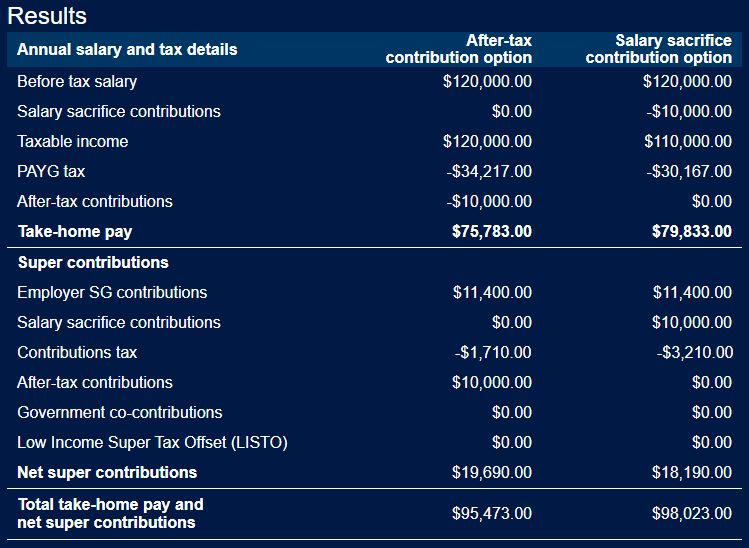

Our Salary sacrifice calculator helps you to compare the effect on take home pay and super contributions by making additional super contributions using two different methods ie as a salary sacrifice contribution or as an after-tax contribution. There are other costs depending on your employer that you can salary sacrifice in order to pay less tax. Is salary sacrifice super worth it.

7 lignes In order to salary sacrifice into super you will need to notify your employer of how much of. This is on top of what your employer might pay you under the Superannuation Guarantee which will. Can anyone salary sacrifice into super.

They include personal before-tax contributions you make via salary sacrifice Superannuation Guarantee contributions your employer pays for you and any after-tax personal contributions you make and claim a tax deduction for. Seven things you need to know about salary sacrificing into super 1. When you salary sacrifice you arrange with your employer to contribute an additional amount to your super out of your pre-tax pay.

If you earn more than 45000 salary salary sacrifice into superannuation is an easy win. The amount you salary sacrifice into super is generally taxed at 15 per cent which for most people will be less than the tax you may pay on that income 1 personally if it was paid to you as salary. Salary sacrificing for super involves contributing pre-tax dollars from your salary into.

Salary sacrificing into super offers several benefits. Anyone can salary sacrifice into super -. Because its directed into your super before any income tax is withheld that money is taxed at the lower super tax rate of 15 instead of your standard income tax rate this could be as high as 45 depending on what you earn.

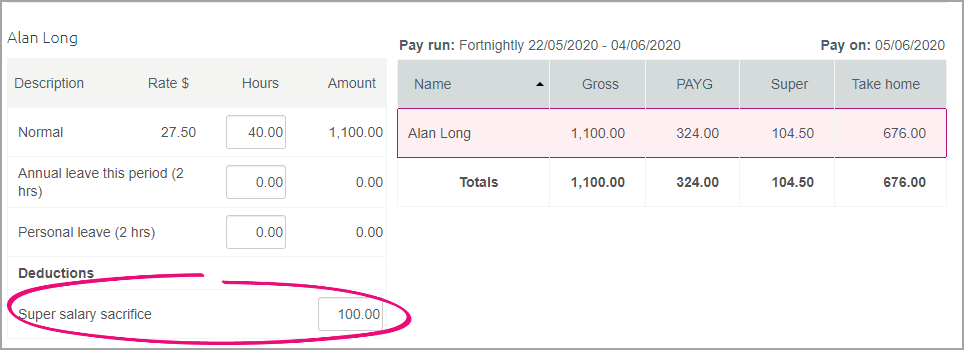

In this video well look at how to setup and process a Superannuation salary sacrifice agreement in XeroWell also cover off a couple of common scenariosTO. This calculator generates factual information about the potential effect of those methods on take home. Just complete the form online and send it to your employer.

Salary sacrifice to super - is this grossed up. Duckys Accordingly in order to make Salary sacrifice super work as per the ATO policy you will have to increase the gross wage to reflect the amount keeping in mind salary sacrifice super should also incur Super guarantee from 1st Jan 2020. I am a single parent and receive child support and family tax benefits.

Salary sacrificing super Salary sacrifice is an arrangement with your employer to forego part of your salary or wages in return for your employer providing benefits of a similar value. Salary sacrificing into super is where you choose to have some of your before-tax income paid into your super account by your employer.

Salary Sacrifice More Super Less Tax Wealth Depot Financial Advisers

Upgrade Your Future With Salary Sacrifice Mercer Financial Services

Standard Salary Sacrifice Agreement Rei Super

Salary Sacrifice Boost Your Super Mlc

Salary Sacrifice More Super Less Tax Wealth Depot Financial Advisers

Building Your Super Intrust Super

Peakwm Seven Things You Need To Know About Salary Sacrificing

Super Salary Sacrificing Highview Accounting Financial

What Is Salary Sacrifice And Is It Still Relevant Practical Systems Super

Salary Sacrificing To Super Mc Ewen Investment

Salary Sacrifice Forrest Private Wealth

Salary Sacrifice Aim To Retire With 5 Million Fiducian Group

Salary Sacrifice Alphington Private Wealth

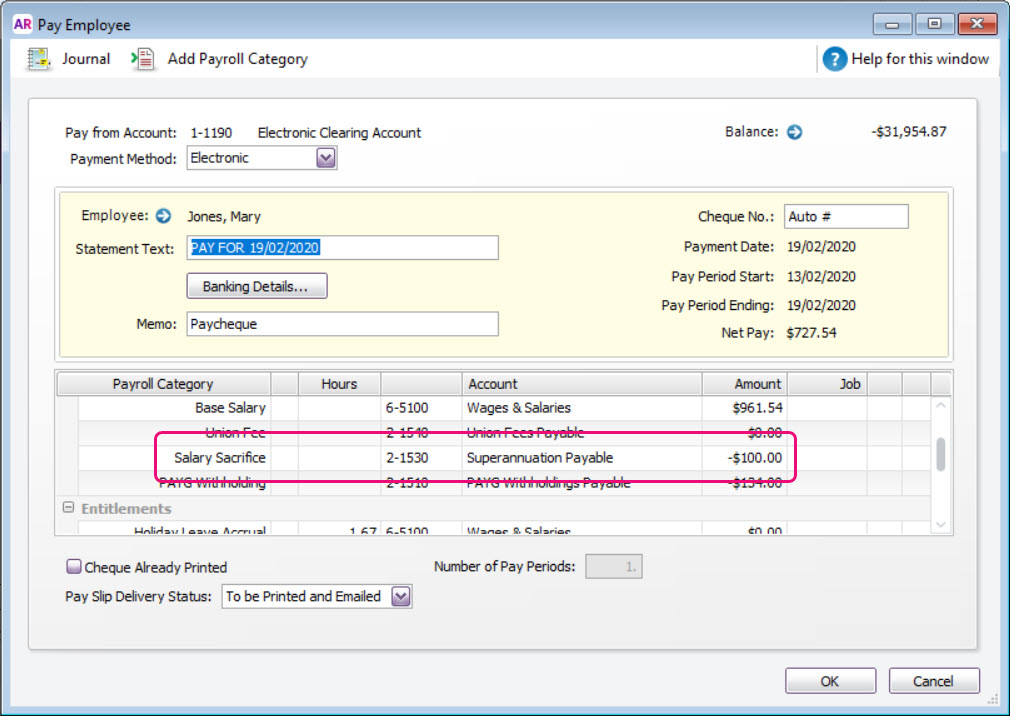

Setting Up Salary Sacrifice Superannuation Myob Essentials Accounting Myob Help Centre

Content Mercer Super Trust Australia

Set Up Salary Sacrifice Superannuation Myob Accountright Myob Help Centre

Salary Sacrificing Into Super Alturafinancial Com

Post a Comment for "Salary Sacrifice To Super"